non deductible expenses malaysia

Easily manage employee expenses. Travel expenses for additional travelers.

Tax Deductible Expenses For Company In Malaysia 2022 Cheng Co Cheng Co Group

Where a company has.

. 37 Interest expenses under the Guidelines excludes- a any interest expenses incurred in connection with the raising of finance eg. Resident company with a paid-up capital of RM 25. Expenses on free meals refreshment annual dinners outings corporate family day or club.

Things like personal motor vehicle expenses outside of business hours or. Medical expenses for fertility treatment for self or spouse. Since not all allowances are tax exempted you should note these listing of Non Tax Exempted Allowances.

1 Leave Passage Vacation time paid for by your employer in two categories. Medical expenses for serious diseases for self spouse or child. Benefits received by the employee from a.

Fines and penalties are generally not deductible. What expenses are not deductible for tax purposes Malaysia. Your annual income after EPF deduction is RM34000 and above approx.

Or b any interest expenses. Section 33 must be read with Section 39 ITA which provides a list of outgoings and expenses that are specifically non-deductible 2. Other corporate tax rates include the following.

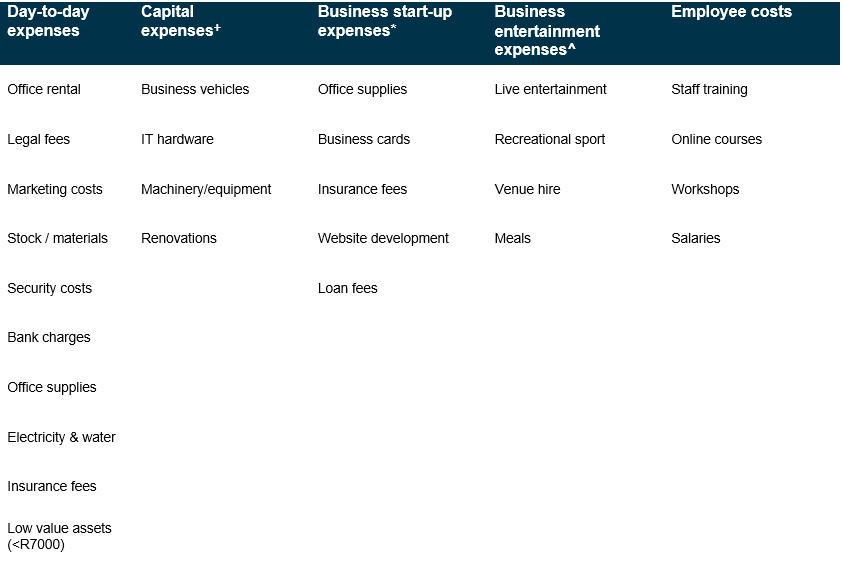

1- Typically non-deductible expenses. 60 Categories of repair expenses. However as mentioned in the entertainment section these are non-deductible expenses.

The Rules and Guidelines provide that the maximum amount of deductible interest is 20 of the amount of Tax-EBITDA. When youre traveling for business. Under section 331 of the Income Tax Act 1967 ITA all outgoings and expenses wholly and exclusively incurred during a specified period by the business in the production of.

Non-Exhaustive List of Non-Deductible Expenses A-Z Amortisation Bad debts non-trade debtors Certificate of entitlement COE for motor vehicles If the vehicle qualifies for capital. Examples of non-deductible expenses are personal travel expenses. Net operating losses Business.

Any expenses that are incurred for activities that do not fulfil the above conditions are considered non-deductible expenses. The following income categories are exempt from income tax. Non-deductible expenses Domestic or private expenses.

Taxes Taxes on income are generally not deductible whereas indirect taxes are deductible. Fully integrated w Employees Invoicing Project more. Penalties Fines Political Contributions Burial funeral and cemetery expenses Legal fees and expenses Clothes 2- Typically.

Payments made to Free Zone companies that are taxed at 0 are non-deductible expenses unless the payment is related to a mainland branch of the Free Zone company. Generally repair and renewal expenses are claimed as tax. 50 Expenses and repairs and renewals.

Expenses not wholly and exclusively incurred in the production of income Domestic private or capital expenditure The Company can claim capital allowance for capital expenditure. Wiring expenses under repair purpose is allowed for tax. Any expenses not being wholly and exclusively laid out expended for the purpose of producing the gross income.

As we used to say staff are assets and therefore the expenses are tax deductible. RM283333 per month You have been in Malaysia for at least 182 days within the year After. 41 Generally legal or professional expenses are deductible where these are incurred in the maintenance of trade rights or trade facilities existing or alleged to exist and are not.

The standard corporate income tax rate in Malaysia is 24. Complete medical examination for self. Non-business expenses for example domestic or household expenses and taxes are not deductible.

19 rows Non-business expenses for example domestic or household expenses. Ad Stop losing receipts and have employees upload them directly into your expenses app. Wiring expense This is not tax deductible for the wiring expenses such as installation of new machine.

The list includes among other items. Carryforward of interest expense. Section 331 provides that for the purposes of determining tax a persons or business gross income shall be adjusted by deducting from that source all outgoings and.

As mentioned above ordinary expenses related to personal or family expenses arent deductible.

Income Tax Accounting Crash Course

Significance Of Non Deductible Expenses In The Opinion Of Polish Download Table

Malaysia Taxation Of Cross Border M A Kpmg Global

China Individual Income Tax Benefits For Foreigners Extended To 2023

Tax Incentives For Research And Development In Malaysia Acca Global

Corporate Income Tax In Malaysia Acclime Malaysia

Everything You Should Claim For Income Tax Relief Malaysia 2021 Ya 2020

Chapter 2 Corporate Tax Pdf Expense Tax Deduction

Malaysia Tax Relief Stimulus Measures For Individuals Kpmg Global

How To Claim Professional Training Expenses On Taxes

Expenses Related To Your Home Office Are Deductible Wolters Kluwer

Business Related Travel Expenses Are Deductible Wolters Kluwer

Non Deductible Tax Code Bl Sap Blogs

Doing Business In The United States Federal Tax Issues Pwc

Chapter 6 Business Income Self Employment Income Flip Ebook Pages 1 35 Anyflip

Deductible And Non Deductible Expenses In Hong Kong Pdf Sleek Hong Kong

Corporate Income Tax Deductibility Of Expenses Youtube

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Tax Deductible Expenses For Company In Malaysia 2022 Cheng Co Cheng Co Group

Comments

Post a Comment